Auto Insurance in and around Westerville

Take this great auto insurance for a spin, Westerville

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Everyday life often takes on a rather predictable routine. We drive to school, book clubs, violin lessons and work. We go from one thing to the next and back again, almost automatically… until the unexpected happens: things like collisions, cracked windshields, darting deer, and more.

Take this great auto insurance for a spin, Westerville

Insurance that won't drive you up a wall

Navigate The Road Ahead With State Farm

Your vehicle will thank you for making sure you're prepared with State Farm insurance. This can look like emergency road service coverage, collision coverage and/or medical payments coverage, and more. That's not all! There are also a variety of savings options including a newer vehicle safety features discount, accident-free driving record savings and an anti-theft discount.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever trouble finds you on the road to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

Call Anthony at (614) 656-1932 or visit our FAQ page.

Simple Insights®

Choose your car insurance deductibles and coverages well

Choose your car insurance deductibles and coverages well

Learn what a car insurance deductible is and how it affects your car insurance coverage. Plus, tips on choosing a policy that works for you.

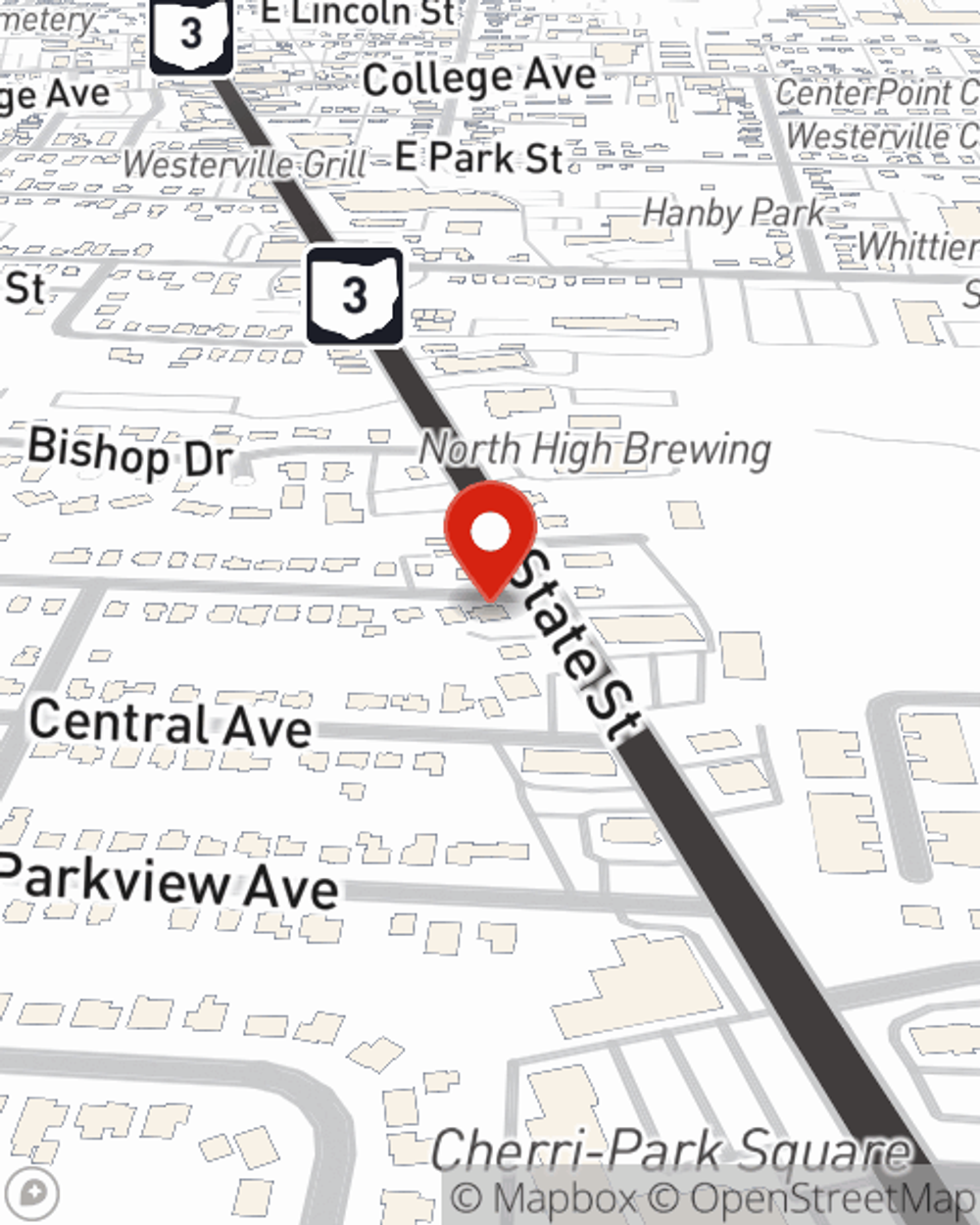

Anthony Pelfrey

State Farm® Insurance AgentSimple Insights®

Choose your car insurance deductibles and coverages well

Choose your car insurance deductibles and coverages well

Learn what a car insurance deductible is and how it affects your car insurance coverage. Plus, tips on choosing a policy that works for you.